The end of a calendar year often brings last minute tax planning. Taxpayers rush to harvest capital losses, make additional IRA contributions, prepay deductible expenses, or “bunch” charitable contribution deductions into a donor-advised fund, all in effort to lower an April tax bill. Amidst the flurry of last-minute tax planning, the end of a calendar year is an optimal time to review changes that may impact planning in the upcoming year.

Expect Inflation Adjustments

The 2020 inflation adjustments include an increase in the standard deduction from $24,400 to $24,800 for married taxpayers, from $12,200 to $12,400 for single taxpayers, and from $18,350 to $18,650 for heads of household. Additional inflation adjustments also include an increase in the credit allowed for adopting a child with special needs from $14,080 to $14,300 and an increase in the penalty for failure to file a tax return within 60-days from $205 to $330.

Income Tax Bracket Adjustments

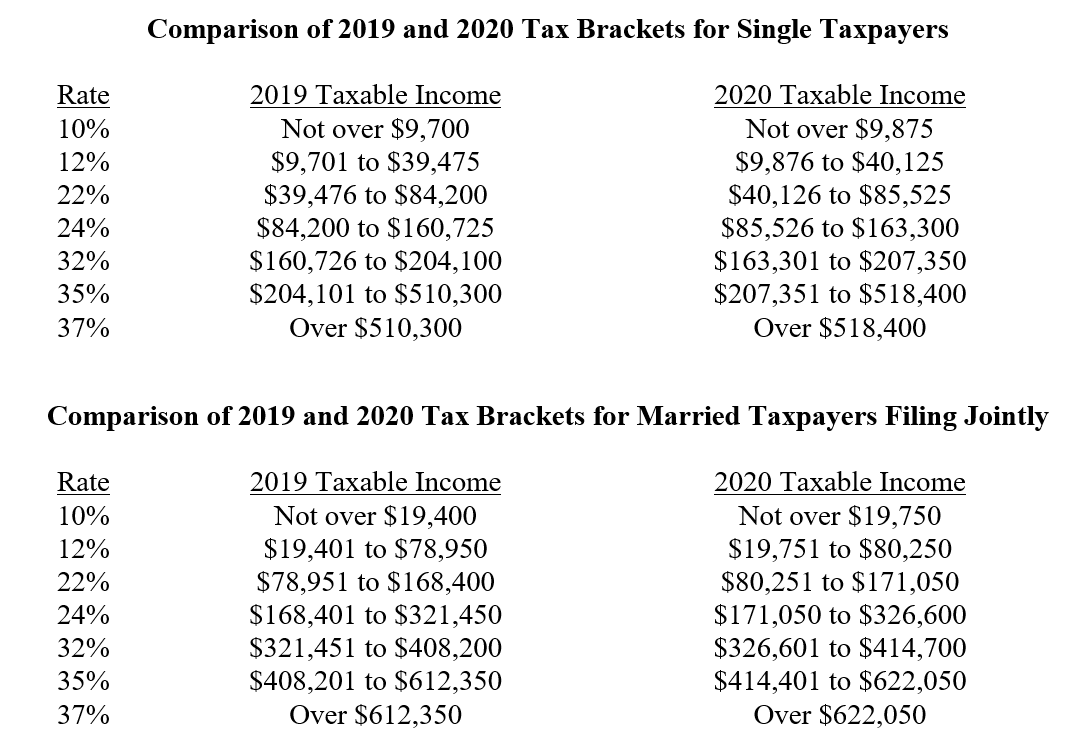

Be aware of adjustments to the income tax brackets. The 2020 tax rates themselves will remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37% respectively, however, the transition point from one rate to the next will increase. The tables below provide a comparison of the 2019 and 2020 rates and brackets.

What does this mean to individual taxpayers?

It means if your taxable income in 2019 is identical to your taxable income in 2020, then your overall tax bill will be lower. This increase in transition points will cause more taxable income to be subject to income tax at a lower rate. In addition to the income tax changes, the IRS also recently announced the 2020 estate and gift tax figures. The applicable credit amount against estate tax will increase from $11,400,000 for people who pass away in 2019 to $11,580,000 for people who pass away in 2020. This means that the total value of a person’s estate must exceed $11,580,000 in 2020 before having to file, and potentially pay, federal estate tax. The gift tax annual exclusion amount, the amount you can give as a gift to any person during the calendar year without having to file a gift tax return, remains unchanged at $15,000.

If you would like to review your current estate plan with respect to these tax law adjustments or to discuss end of year tax reduction strategies, please contact your lawyer at Carlile Patchen & Murphy LLP or any member of the Family Wealth & Estate Planning Group.

0 Comments